Fund your future

Ascent helps Springboard students pay tuition by offering a simple, straightforward deferred tuition loan. You deserve a valuable education, and we think financing it should be easy.

Please note there may be other ways for you to pay for your Springboard program that may be less expensive than an Ascent Deferred Tuition Loan. Please contact Springboard for more details.

Submit an application without impacting your credit score. Choose how much you'd like to borrow, get pre-qualified in minutes, and get started on your career-transforming program. Plus, you can receive a 1.00% discount for enrolling in automatic payments.

Real reviews from real customers

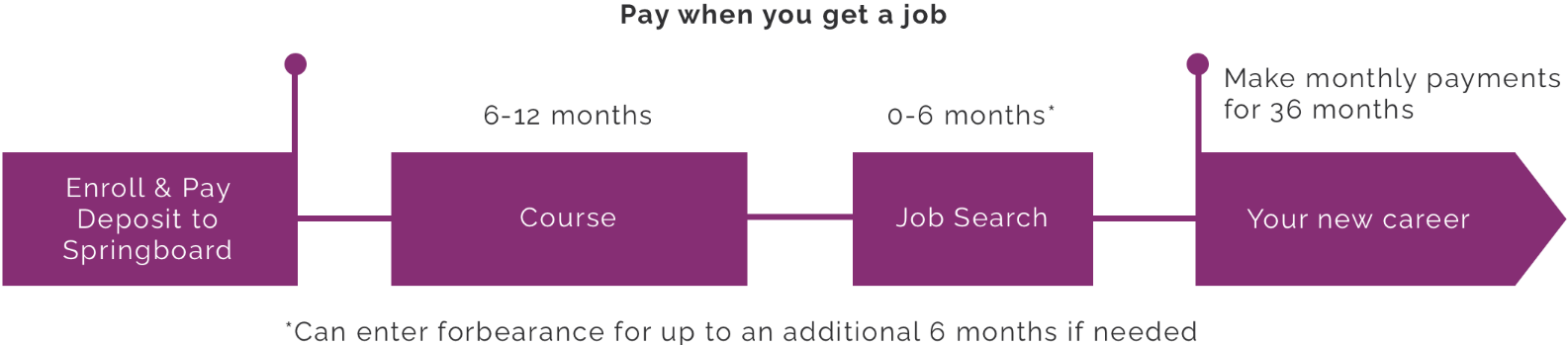

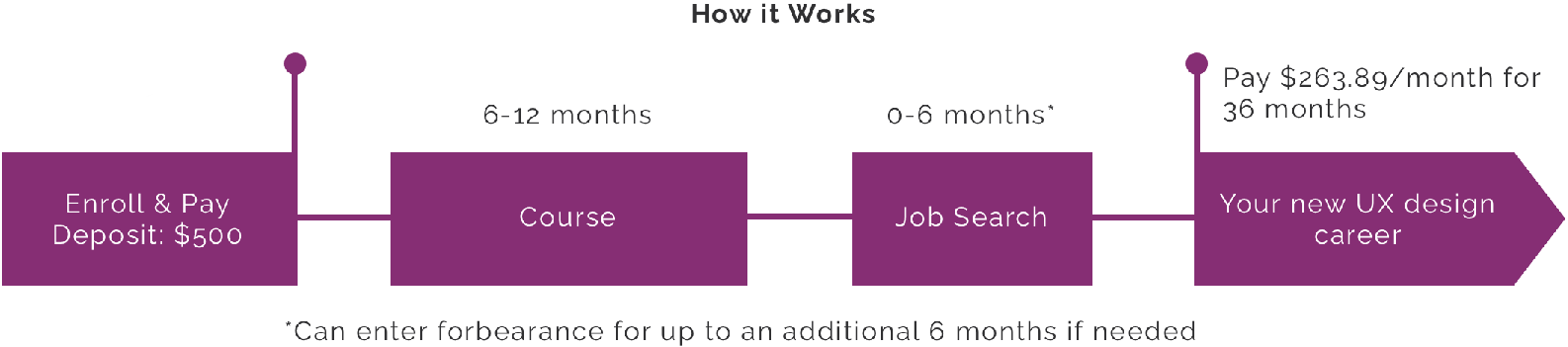

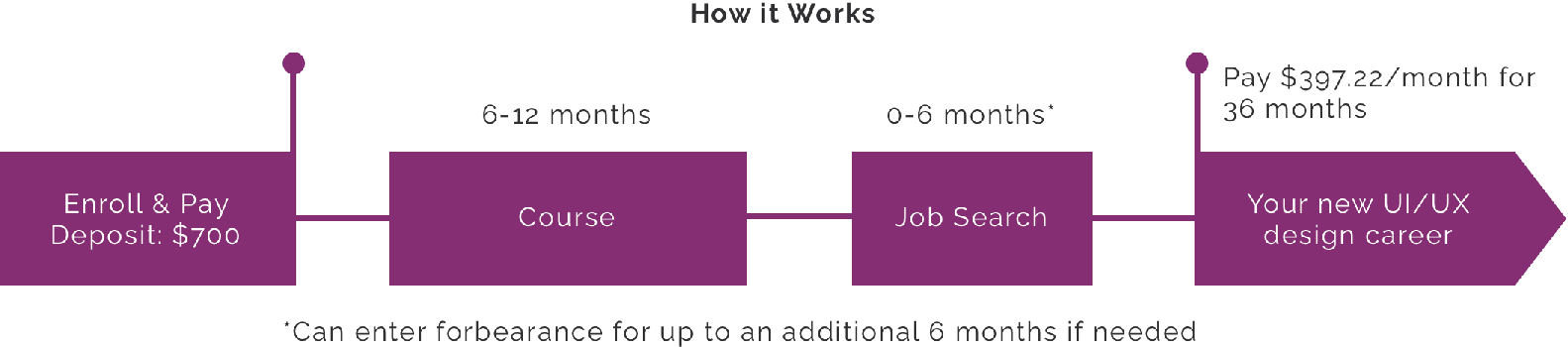

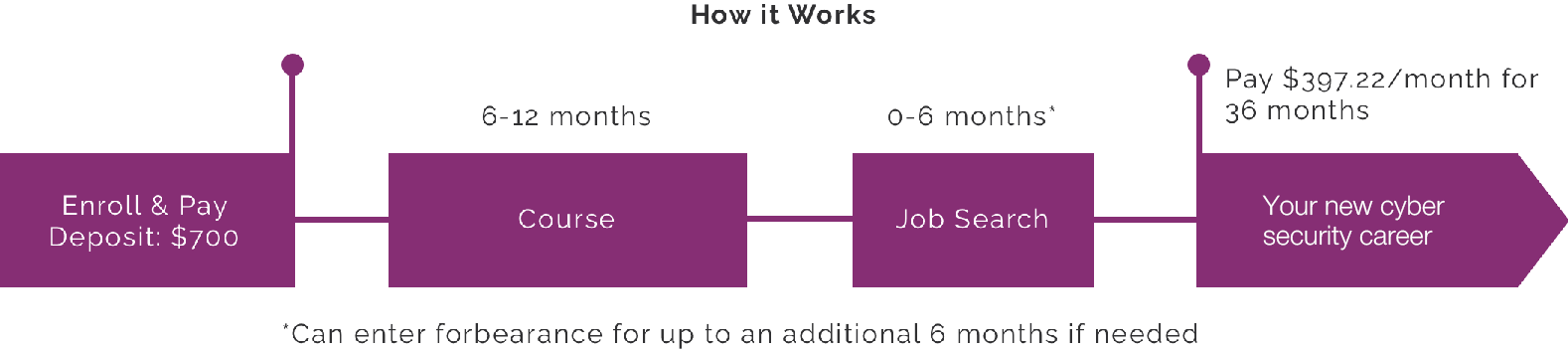

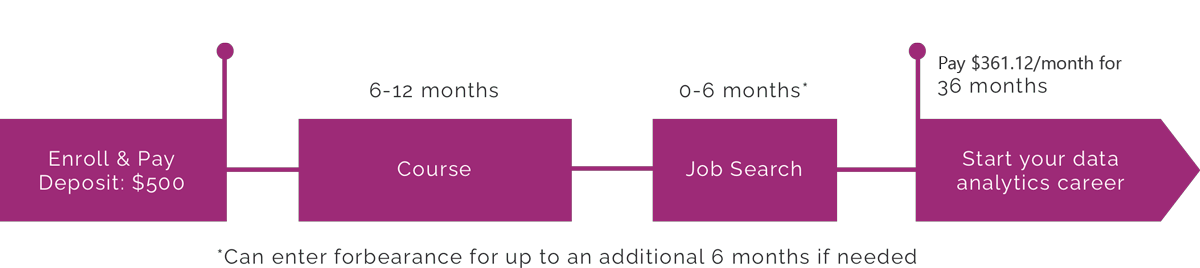

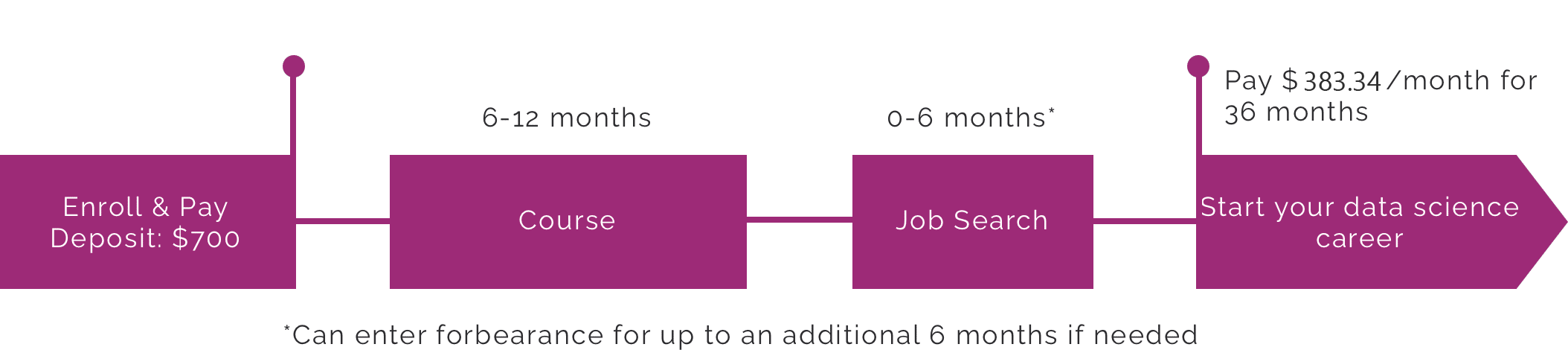

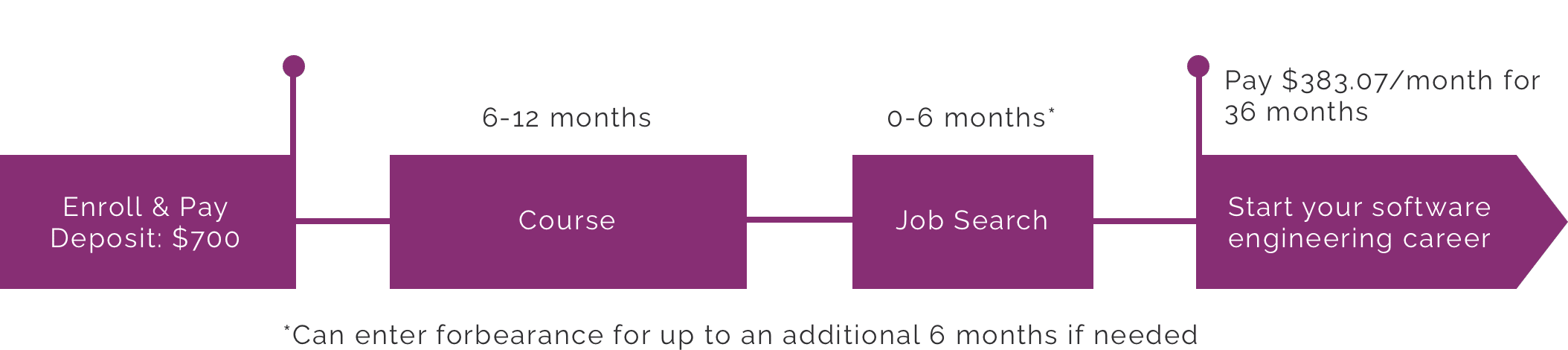

A monthly payment plan built for you

With a Deferred Tuition loan, you won’t make payments until you receive an offer for a qualifying position as defined in the Springboard Guarantee. Once you receive an offer for a qualifying position, you’ll begin making monthly payments. If you do not receive a qualifying offer within six months of completing your program and you meet the requirements of your Springboard Guarantee, your loan will be canceled, your deposit will be refunded, and you will owe nothing. Plus, you can receive a 1.00% discount for enrolling in automatic payments with an Ascent loan.

Learn now, pay later

After the initial deposit to Springboard, make no payments for up to a year after graduation.

Know exactly what you’ll pay

Download the Ascent app to monitor interest and total balance in real-time as you progress through the course and job search. Prepay any amount at any time with no penalties.

Fixed monthly payments

Once you receive a qualifying job offer—or six months after completing your program—you’ll begin making low, fixed monthly payments for 36 months.

Preview loan & payment amounts

View your loan options and see repayment examples for your Springboard program. Our student-friendly loans include fixed monthly payments, total costs, no prepayment fees, and a 1.00% discount for enrolling in automatic payments.

Please note there may be other ways for you to pay for your Springboard program that may be less expensive than an Ascent loan. Please contact Springboard for more details.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$455.64

Total Cost of Program (plus deposit):

$16,903.12

Desposit due to Springboard:

$500

Interest Rate:

12.99%

Annual Percentage Rate:

14.72%

Borrowed Amount:

$11,400

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$541.10

Total Cost of Program (plus deposit):

$20,179.77

Desposit due to Springboard:

$700

Interest Rate:

12.99%

Annual Percentage Rate:

14.41%

Borrowed Amount:

$13,160

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$447.65

Total Cost of Program (plus deposit):

$16,815.35

Desposit due to Springboard:

$700

Interest Rate:

12.99%

Annual Percentage Rate:

14.72%

Borrowed Amount:

$11,200

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$431.66

Total Cost of Program (plus deposit):

$16,039.80

Desposit due to Springboard:

$500.00

Interest Rate:

12.99%

Annual Percentage Rate:

14.72%

Borrowed Amount:

$10,800

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$527.59

Total Cost of Program (plus deposit):

$19,639.09

Desposit due to Springboard:

$700

Interest Rate:

12.99%

Annual Percentage Rate:

14.72%

Borrowed Amount:

$13,200

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Deferred Tuition Loan Repayment

36 Months

This example shows no monthly payments while in school and for a 6 month grace period after completion, then full repayment for 36 months post-school.

Monthly In-School Payment:

$0.00

Monthly Post-School Payment:

$541.10

Total Cost of Program (plus deposit):

$20,179.77

Desposit due to Springboard:

$700

Interest Rate:

12.99%

Annual Percentage Rate:

14.41%

Borrowed Amount:

$13,160

Example assumes the student is financing the full tuition amount with an Ascent Deferred Tuition loan. Interest accrues from the day of disbursement. Please note that any additional in school period will impact the monthly post-school payment and total cost of program.

Frequently asked loan questions

The Deferred Tuition loan option is available to students who meet the requirements of the Springboard Guarantee. Please get in touch with a Springboard Admissions advisor for more details.

Our goal at Ascent is to help students from all walks of life and with a broad range of backgrounds get access to the programs that interest them. We offer two possible ways to qualify for an Ascent loan: on your own or with a cosigner.

To see if you pre-qualify for an Ascent bootcamp loan, submit an application. In the pre-qualification process, we’ll conduct a soft credit check with no impact to your credit score. In addition to learning more about your eligibility, you can also see the rates and terms you pre-qualify for.

Applicants must be U.S. citizens, permanent residents, or DACA recipients with established credit history & no outstanding education loan defaults. U.S. temporary residents may apply with a creditworthy cosigner that is a U.S. citizen or U.S. permanent resident.

Adding a cosigner can help strengthen your application’s overall credit health, and may even help lower your loan’s interest rate, APR, or monthly payments.

No, payments are not required during school and while you’re in the six-month job search period.

You have several options, including automated payments! After you apply, we’ll help you set up your repayment account. You’ll make your first payment when you receive a qualifying job offer, or six months after completing your program, whichever comes first.

You’ll make monthly payments for 36 months, and we’re happy to say there’s no prepayment penalty or fee for early payments. You can choose to pay the minimum monthly payment, or you can make larger payments. If you choose to make larger monthly payments, you will incur less interest and your total Deferred Tuition loan cost will be less. You have the flexibility to pay off your loan anytime before your loan term ends!

If you do not find a job during the six-month job search period, you may defer repayment for up to an additional six months. Please get in touch with your servicer.

Launch Servicing is the servicer for your Deferred Tuition loan. This means Launch will collect your monthly payments during the repayment phase of your loan. Need to pay your loan? Have a question about repayment on an existing loan? Visit Launch online or at 877-209-5297.

Once you’ve begun full repayment (after the grace and/or interest only period), your loan term will be 36 months.

You will be charged an origination fee of 5.0%. This will be added to the amount you borrow and is included in the total loan principal amount you finance. It helps cover the administrative fees associated with originating the Deferred Tuition loan. It is the only fee charged for taking out this loan. The APR for Ascent loans includes the origination fee and interest rate. See rates and repayment examples by program

Interest rate:

12.99%, regardless of credit score

Annual Percentage Rate:

Cyber Security Career Track - 14.72%

Data Analytics Career Track - 14.72%

Data Science Career Track - 14.72%

Software Engineering Career Track - 14.41%

UI/UX Design Career Track – 14.41%

UX Career Track - 14.72%

Springboard offers a refund policy in certain situations. Please refer to the Springboard Job Guarantee. Please note that the Deferred Tuition Loan option is available to students who meet the requirements of the Springboard Guarantee. Please get in touch with a Springboard Admissions representative for more details.

If you meet the requirements of the Springboard Job Guarantee and do not find a qualifying job within six months, your loan will be canceled and you will owe nothing. If you do not meet the requirements of the Springboard Job Guarantee and do not find a qualifying job within six months, you may continue to defer payments on a monthly basis for up to an additional six months with your loan servicer. If after one year you still do not have a qualifying job offer, you will begin repayment one year after completing your program.

If you withdraw from your program within the seven-day refund period, your Deferred Tuition loan will be refunded and you will owe nothing. If you withdraw after the seven-day refund period, you will be charged a prorated amount per month, as determined by Springboard. You will have a three-month grace period after withdrawing from your program before you begin making payments, then you’ll make 36 monthly payments that total the prorated amount you owe.

Yes, you can add a cosigner to your Deferred Tuition loan. There are two ways to qualify for an Ascent loan: on your own, or with a cosigner. Depending upon your credit health, a cosigner might be required. Cosigners may strengthen your application’s overall credit health. If you’re concerned about your eligibility for an Ascent loan, consider adding a cosigner with strong credit health. Additionally, a student who is not a U.S. citizen or U.S. permanent resident or has Deferred Action for Childhood Arrival (DACA) status may apply with a creditworthy cosigner who is a U.S. citizen or U.S. permanent resident.

We’ve made this process easy. You can choose to add a cosigner before you submit your loan application, or may be given the option to add a cosigner after you apply.

If you’d like to add a cosigner when you apply, you can select this option in the application. If your cosigner is with you, they can start their portion of the application right away. If not, we’ll send them an email asking them to complete their part. Your cosigner’s portion of the application will look very similar to yours.

We’ll keep you and your cosigner updated on the status of your application throughout the process. You’ll receive an email or a notification in the application if you or your cosigner have any required steps to take.

Richland State Bank, member FDIC, is the lender for all Ascent bootcamp loans.

Yes. Individuals may apply as a borrower or cosigner based on their citizenship status as follows:

- U.S. Permanent Residents – as a solo borrower, as a cosigner or as a borrower with a qualified cosigner.

- Deferred Action for Childhood Arrival (DACA) status – as a solo borrower or as a borrower with a qualified cosigner.

- U.S. Temporary Residents – as a borrower with a qualified cosigner only.

Documentation requirements: The following are documentation will be required to verify your individual resident status:

- For U.S. Permanent Residents: Provide a Permanent Resident Card.

- For DACA status: Provide documentation from the U.S. Department of Homeland Security / U.S. Citizenship and Immigration Services (USCIS) that indicates DACA status that does not expire within 6-months of the end of the enrollment period for which the loan is being requested.

- For U.S. Temporary Residents:

A VISA that does not expire within 6-months of the end of the enrollment period for which the loan is being requested. with an acceptable category as follows: F-1, F-3, G Series, H-1B, H-1C, H-2B, H-3, J-1, L-1, M-1, M-3, T-1, TN

OR

An I-20 Form (pages 1 & 2 and signed by the school) and an unexpired passport from country of origin.

OR

Form I-797, Notice of Action and unexpired passport from country of origin from an eligible Temporary Protected Status country from this list: https://www.uscis.gov/humanitarian/temporary-protected-status.

No, they’re consumer loans to help pay for tuition or cost of living at our partner schools.

There are several key differences, and we encourage applicants to perform their own research into this topic. However, some of the high-level differences between an Ascent consumer loan for bootcamps and a private student loan include:

- For private student loans, interest paid may be tax-deductible. For consumer loans for bootcamps, interest is not tax-deductible. Please consult your tax advisor to determine if this applies to you.

- Consumer loans for bootcamps may be treated differently in the event of a borrower bankruptcy.

- Private student loans may typically only be used for qualified education expenses as defined by the IRS.

You can submit an application and become pre-qualified as early as 90 days before your program. In the pre-qualification process, we’ll conduct a soft credit check with no impact to your credit score. Before accepting a loan option, please ensure you have enrolled in your program.

Yes, you can prepay your loan at any time without penalty. You have the flexibility to make early payments or fully pay off your loan without prepayment fees.

Your interest rate is the base cost of borrowing money for the duration of your loan and is a percentage of the principal loan amount. It can be fixed (it will not change) or variable (it could change over time). Variable interest rates can increase or decrease throughout the life of your loan, which may result in your monthly payment changing over time. All Ascent loans for Springboard are fixed rate – your rate won’t go up!

To see the status of your loan application, visit your Ascent account dashboard at bootcamp.ascentfunding.com. We’ll also send you emails throughout the process to keep you updated. You can save your progress in the application and return to it at any time.

No, you can reduce your total cost by making early payments! This is a benefit we hope our borrowers take advantage of. When you apply for a loan, we show you as many details as we can upfront. One of those details is the total cost of the loan, which is the total amount you’ll pay over the scheduled lifetime of the loan. Our calculation of the total cost assumes that you will pay off your loan by making monthly on-time minimum payments for your entire loan term, which is 36 months. The total cost includes (1) the origination fee of 5% of your loan amount, (2) the loan amount, and (3) the interest accrued over the lifetime of the loan.

With our loans, you can make early payments or fully pay off your loan at any time with no prepayment fees. Many of our borrowers graduate from their programs, land jobs, and pay off their loans early! This is a financially smart move, because if you make early payments, you’ll accrue less interest over the lifetime of your loan. In summary – we don’t hold you to the total cost you see in your loan offers. If you make early payments, you can reduce the interest you accrue, which reduces your loan’s total cost!

You can get a 1.00% interest rate reduction (depending on loan terms) if payments on your Ascent loan are made by automatic payment. The Automatic Payment Discount is available if you are enrolled in automatic payments from your personal checking account and the amount is successfully withdrawn from the authorized bank account each month. Any loans originated prior to March 11, 2024 will receive a 0.25% interest rate discount if payments are made automatically. Any loans originated on or after March 11, 2024 will receive a 1.00% interest rate discount if payments are made automatically. (See Automatic Payment Discount Terms & Conditions.)

Our team is here to help.

For any additional questions, please complete this form.

Want to learn more?

We’ll send you our step-by-step

guide to paying for your program.