No fees4

No application, disbursement, prepayment or late fees

College Loans fixed APRs starting at

Fixed APRs starting at

2.69%*

168,000+ people have used Ascent to pay for school**

Stay focused on your goals – we’ll cover the expenses. From books to bills, Ascent student loans can pay for exactly what you need. Borrow as little as $2,001† up to your full cost of attendance so you can keep moving forward.

Start an Application†The minimum loan amount is $2,001, except for the state of Massachusetts. The minimum loan amount for borrowers with a Massachusetts permanent address is $6,001. Your maximum loan amount will be determined according to Ascent's Ts&Cs and your school's certification of the loan amount.College is hard work, but applying for an Ascent student loan is fast and easy. Ascent offers college student loans for cosigned and non-cosigned undergraduate students, graduate students, and parents.

Start an ApplicationNo application, disbursement, prepayment or late fees

Low fixed rates starting at 2.69% APR* and low variable rates starting at 3.66% APR*

Up to 40 flexible repayment options3 – no other student loan offers more.

Access to paid, remote internship opportunities and resources to help you reach long-term goals1

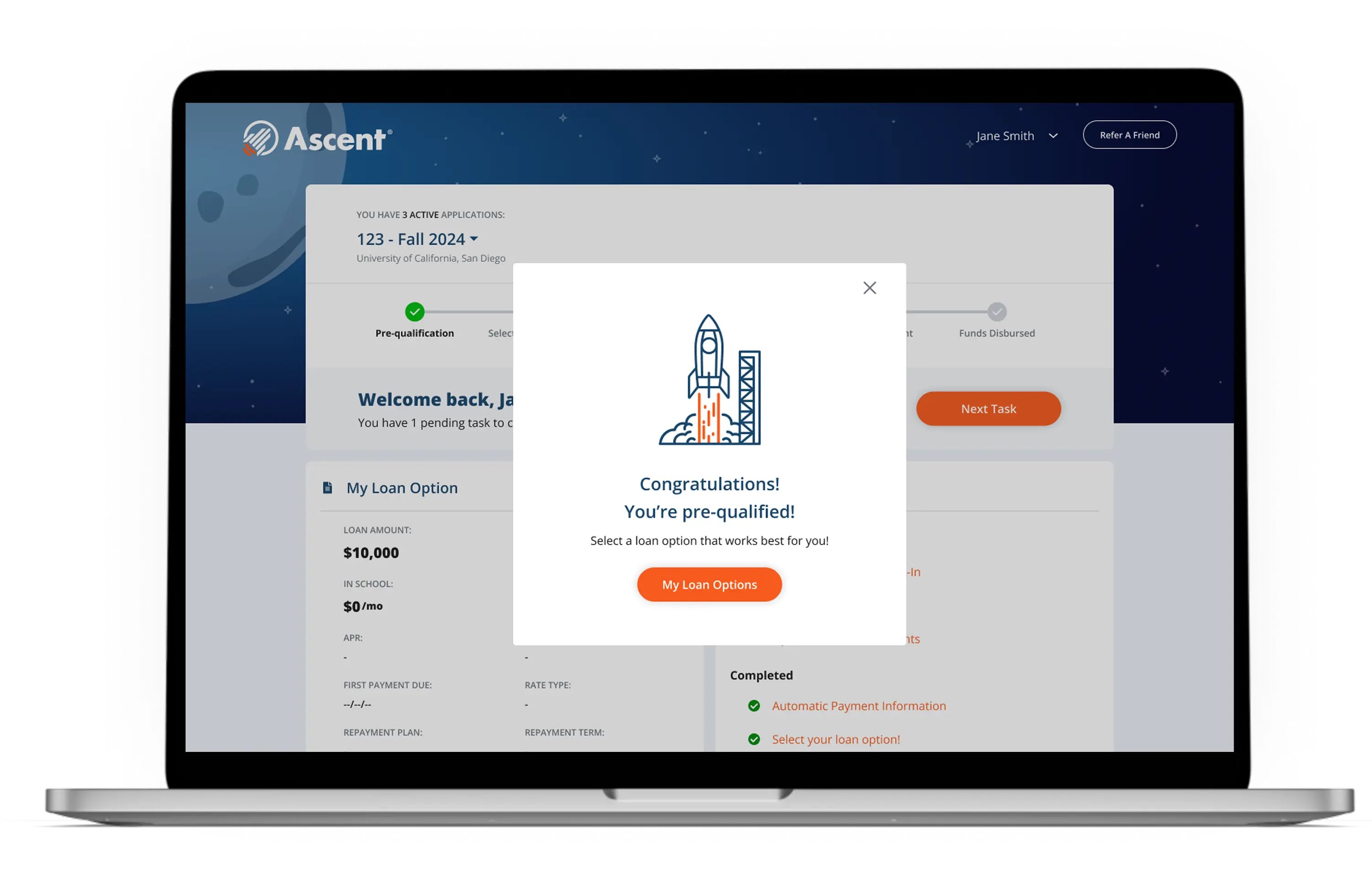

You provide details like your name, school, and date of birth to see if you pre-qualify without impacting your credit score. If you have a cosigner, they’ll also enter their information.

Once you're pre-qualified, you can view your rate and monthly payment options, and choose the repayment plan that works best for you.

Ascent confirms your eligibility with a hard credit check, you provide any additional information needed, and your school confirms your enrollment.

Ascent sends your tuition to your school so you can focus on your education and bright future. When it's time to repay, we help you stay on track.

We offer multiple repayment plans, so you can choose what works best for you! Pre-qualify in minutes to compare your options and preview your payments.

Start an Application

You can preview your rate and repayment options without affecting your credit. We keep things simple with clear terms and no hidden fees4.

Get your questions answered and meet your goals with access to friendly, expert help on academic, career, and finance essentials. We’re invested in your journey to success!

Celebrate graduation with a cash reward2, get a discount when you sign up for autopay, earn money when you refer friends, and enter for a chance to win monthly scholarship giveaways.

Our priority is the success of our borrowers. That’s why Ascent offers innovative support like financial wellness training, college and career coaching, and access to internship opportunities.

In addition to providing financial access to education, we are dedicated to giving learners the real-world resources and confidence they need to excel in college and beyond.

Apply Now| See how Ascent compares 1 3 4 |  |

Industry standard |

| Grace Period | 9 months | 6 months |

| Automatic Payment Discounts | ||

| College & Career Coaching | ||

| No Fees! | ||

| 12-Month Cosigner Release | ||

| Access to Paid Internship Opportunities | ||

| Ease of Discharge in Bankruptcy |

Comparison based on information obtained on lender's websites as of October 2025

of credit-based college loan borrowers increased their credit score5

minutes of financial wellness education accessed

scholarships awarded by Ascent since 2020

Possibly the easiest process I have ever gone through in order to secure a loan.

Everyone was so helpful and nice to work with! Being a first generational College student picking a loan was scary and nerve wracking! but they made it so easy!

I've had such a struggle finding a loan and Ascent made it so simple. Not only was the process a weight lifted off my shoulders, but also ensured that I understood more about loans in general.

Ascent is a leading provider of innovative financial products and student support services that enable more students to access education and achieve academic and economic success.

Students attending an eligible institution and enrolled at least half-time in a degree program may apply for an Ascent loan. Parents, grandparents, guardians, or sponsors of an undergraduate or graduate student enrolled in an eligible school can apply for Ascent’s parent student loan.

Ascent’s credit decisioning criteria is proprietary and subject to change, but you can check your rates without impacting your credit score. We consider credit history and several other factors including, but not limited to, credit score.

Cosigned Credit-Based Loan for undergraduate and graduate students:

Non-Cosigned Credit-Based Loan for undergraduate and graduate students:

Non-Cosigned Outcomes-Based Loan for undergraduate students (juniors and seniors ONLY):

Ascent’s loan process is broken out into 4 easy steps:

Step 1: Apply to see if you pre-qualify

Step 2: Preview your options

Step 3: Ascent confirms your eligibility

Step 4: We send your tuition

With federal student loans, you borrow money directly from the Department of Education. To apply for a federal student loan, you need to complete the Free Application for Federal Student Aid (FAFSA®) application by visiting: https://studentaid.gov/apply-for-aid/fafsa/filling-out.

Private student loans help fill the gap between your college expenses, including books, school supplies, rent, groceries, parking, gas, and anything else not covered by FAFSA or scholarships. Ascent offers flexible options to help you manage your monthly payments as you enter repayment.

Check your rates without impacting your credit score.

Loans subject to individual approval, restrictions and conditions apply. See Terms and Conditions at AscentFunding.com/Rates and AscentFunding.com/Ts&Cs. Loan features and information advertised are intended for Ascent college student loans and are subject to change at any time.

*Annual Percentage Rates (APRs) displayed above are effective as of 03/01/2026 and reflect an Automatic Payment Discount of 0.25% on credit-based college student loans submitted prior to 06/01/2025, a 0.5% discount on credit-based college student loans submitted on or after 06/01/2025, and a 1.00% discount on outcomes-based college student loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower's credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.

**Over 168,000 borrowers took out an Ascent loan for college or career training tuition or expenses between January 2018 and November 2025.

1Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

2Ascent’s 1% Cash Back Graduation Reward is for eligible college students only and subject to terms and conditions. Eligible students must request the graduation reward from Ascent. Learn more at AscentFunding.com/CashBack. 1% Cash Back Reward amount dependent upon total loan amount for Ascent college loan borrowers; approximately $365 average reward amount based upon eligible borrowers who received Cash Back Rewards in 2023. Aggregate cash back limit of $500.

3The final ACH discount approved depends on the borrower's credit history, verifiable cost of attendance, and is subject to credit approval and verification of application information. Automatic Payment Discount consists of 0.25% for credit-based college student loans submitted prior to 06/01/2025, 0.5% for credit-based college student loans submitted on or after 06/01/2025, and a 1.00% discount on outcomes-based college student loans when you enroll in automatic payments. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions.

4Only Ascent college loans are eligible for no fees. Ascent career training loans are subject to a one-time origination fee of 5.0% of the loan amount. All Ascent loans are eligible for no application, disbursement, late, NSF or early payment fees.

5Impact to score may vary. For some, scores may not improve. Results will depend on many factors, including on-time payment history, the status of non-Ascent accounts, and other financial history.