Additional ways to pay for your PhD or master’s degree

Federal financial aid

Many PhD and Master’s students take out federal loans first by filling out the FAFSA, then seek more funding through scholarships and private student loans. Using the FAFSA for Master’s loans and PhD student loans can give you an overview of your federal student loan options.

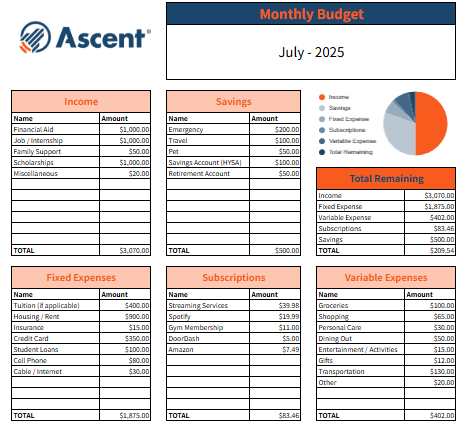

If your federal aid doesn’t cover all your costs, taking out a private health professions student loan can keep you from stressing over your budget while you’re studying.

Scholarships

Ascent also gives out more than $80,000 in scholarships every year to students attending college, graduate school, and bootcamps. There are many chances to win, so make sure to check in regularly to see which scholarships we’re currently running.