Coming up with the money to pay for college can be stressful...

This checklist can help you navigate the complex world of funding your studies with:

Key dates for financial aid and scholarships

Lists of resources you’ll need for the FAFSA

Tips about student loans

Dive into the experience now!

Discover expert tips and best practices to pay for college, including:

- Choosing a school that aligns with your budget

- Understanding tuition bills to manage them effectively

- Getting the most out of your financial aid

- Taking the stress out of student loans and borrowing responsibly

This quick and interactive guide gives parents, guardians, students, and cosigners the confidence to navigate college financing.

Dive In NowChecklist steps and due dates

Below is the most common order in which to find funding for your college degree, including rough times at which these should occur.

-

File Your FAFSA®October through June

-

Apply for Scholarships and GrantsAnytime; deadlines vary

-

Research Private LoansOnce step 3 is complete

-

Apply for Private Student LoansOnce step 4 is complete

More details about the checklist to pay for college

The steps above are overarching, and each has several moving parts to consider. You can check out our guide to paying for college for a complete overview, but here are some primary tips to keep in mind in the meantime:

The Federal Application for Free Student Aid (FAFSA®) lets you apply for government aid and may be required for other types of college applications. To complete your FAFSA®, you will need:

Your Social Security Number or Alien Registration Number (if you are not a U.S. citizen)

Your federal income tax returns, W-2s, and other records of money earned

Note: According to fafsa.ed.gov, you may be able to transfer your federal tax return information into your FAFSA using the IRS Data Retrieval Tool.

Bank statements and records of investments (if applicable)

Records of untaxed income (if applicable)

A Federal Student Aid (FSA) ID to sign electronically

You can visit the Federal Student Aid website to submit your FAFSA® application.

You can apply for scholarships and grants (free money) from a variety of organizations. Each scholarship and grant has its own set of requirements, so pay close attention to the fine print.

Some places to begin your search are:

The Department of Education and your chosen school will work together to create a financial aid package, and all students are offered one. You can accept some, all, or none of the scholarships, grants, and loans offered to you based on your budget.

Private student loans come from banks and other lenders and intend to fill any gaps left over after you’ve exhausted your other options for aid. You’ll want to be sure you’ve thoroughly mapped out your budget to avoid overborrowing.

Each lender has their own requirements, loan terms, and interest rates. Take time to decide which is right for you based on your financial needs and qualifications.

Once you’ve determined what private college loans you need and have chosen a lender, it’s time to apply. Most lenders require at least the following:

Your Social Security Number or Alien Registration Number (if you are not a U.S. citizen)

Your gross annual income

Verification of any assets you own (businesses, investments, etc.)

How much you pay for rent or a mortgage

A copy of your tax returns

Employment information

Personal references

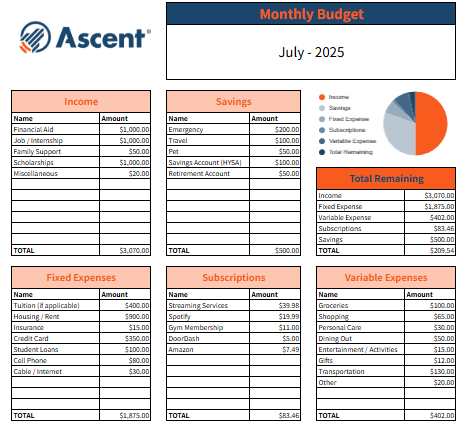

More budgeting tips

If you need assistance when creating your budget, determining how to best prepare yourself for future financial hurdles and successes, or understanding your financial aid options, Ascent is here to help.

We offer many options other private student loan lenders don’t. You can pre-qualify for our college loans in four easy steps to get a preview of what your potential rates and loan terms would be. Whether you’re looking for an undergraduate student loan or a graduate student loan, Ascent has an option that fits your needs.

Ascent also offers international student loans and DACA student loans, with cosigned and non-cosigned options available.

Apply today to find out if Ascent is right for you.

Apply NowPopular blog posts from Ascent

-

Smart Money Moves: The Ultimate Guide to Budgeting for College Students

College is an exciting time to explore, grow, and gain independence—including getting comfortable with money. Budgeting might sound intimidating, but […]

-

A Student’s Guide to Smart Summer Spending & Saving

It’s finally summer! Whether you’re kicking off your mornings with a run, gaming with friends, or soaking up the sun […]

-

How Graduate Students Can Adjust to Grad Plus Loan News

Student loans are a hot topic these days, and for good reason. There have been massive shake ups in education […]

-

SAVE Payment Plan Blocked: What This Means for Borrowers

Student loan borrowers have a lot on their minds–and for good reason. Executive orders threatening the possible elimination of the […]

-

Ascent Named Best Places to Work in Fintech 2025

For the fourth year, San Diego-based fintech recognized for innovative culture Ascent, a leading provider of innovative financial products and […]