How to get your private student loan for international students

You’ve already put a lot of work into preparing for college.

168,000+ people have used Ascent to pay for school**

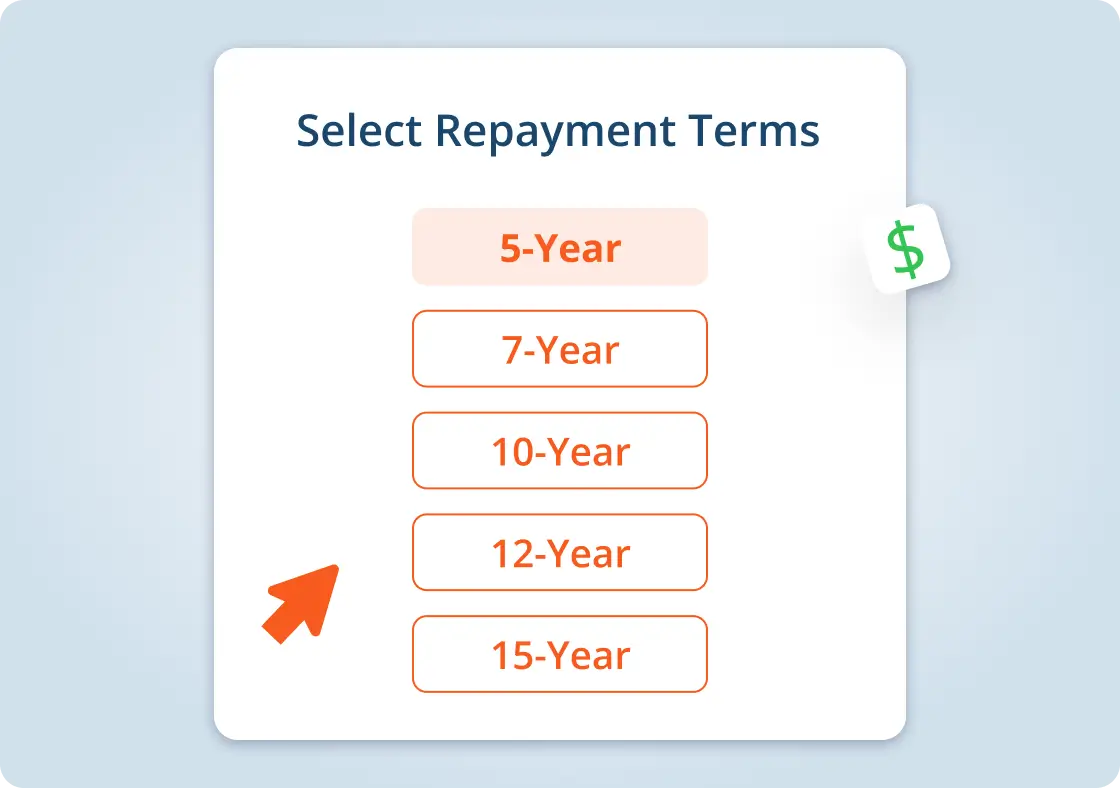

Flexible 5, 7, 10, 12 or 15-year repayment terms for non-cosigned credit-based loan option and 10 or 15-year repayment terms for non-cosigned outcomes-based loan option.

There’s no penalty for early repayment. Ascent repayment examples.

NOTE: For certain loans with low balances, the minimum monthly payment amount may cause the loan amortization schedule to be less than the selected term.

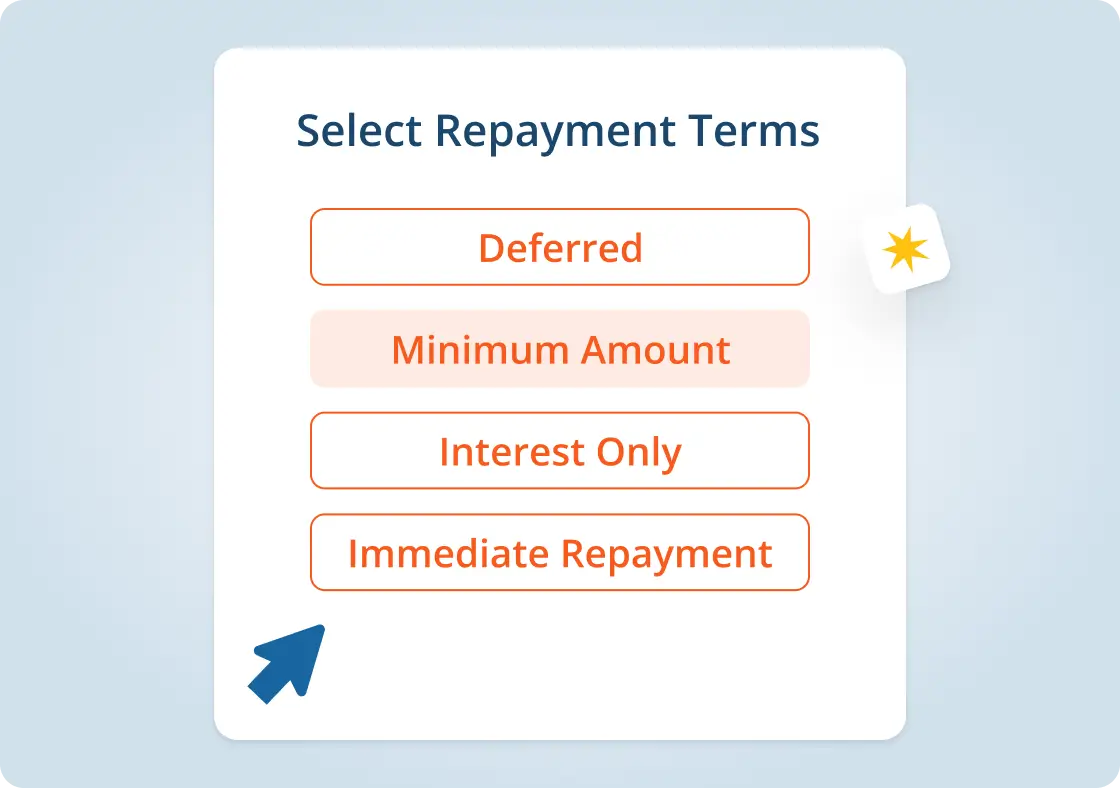

For Ascent’s Non-Cosigned Credit-Based student loan, students can choose from our Interest-Only, $25 Minimum, Deferred Repayment or Immediate Repayment* options.

For Ascent’s Non-Cosigned Outcomes-Based student loan, students can choose our Deferred Repayment option and start payments up to 9-months after graduation or leaving the program.

*The Full P&I (Immediate) Repayment option is only available for college loans (except for outcomes-based loans) originated on or after June 3, 2024. (See Terms & Conditions.)

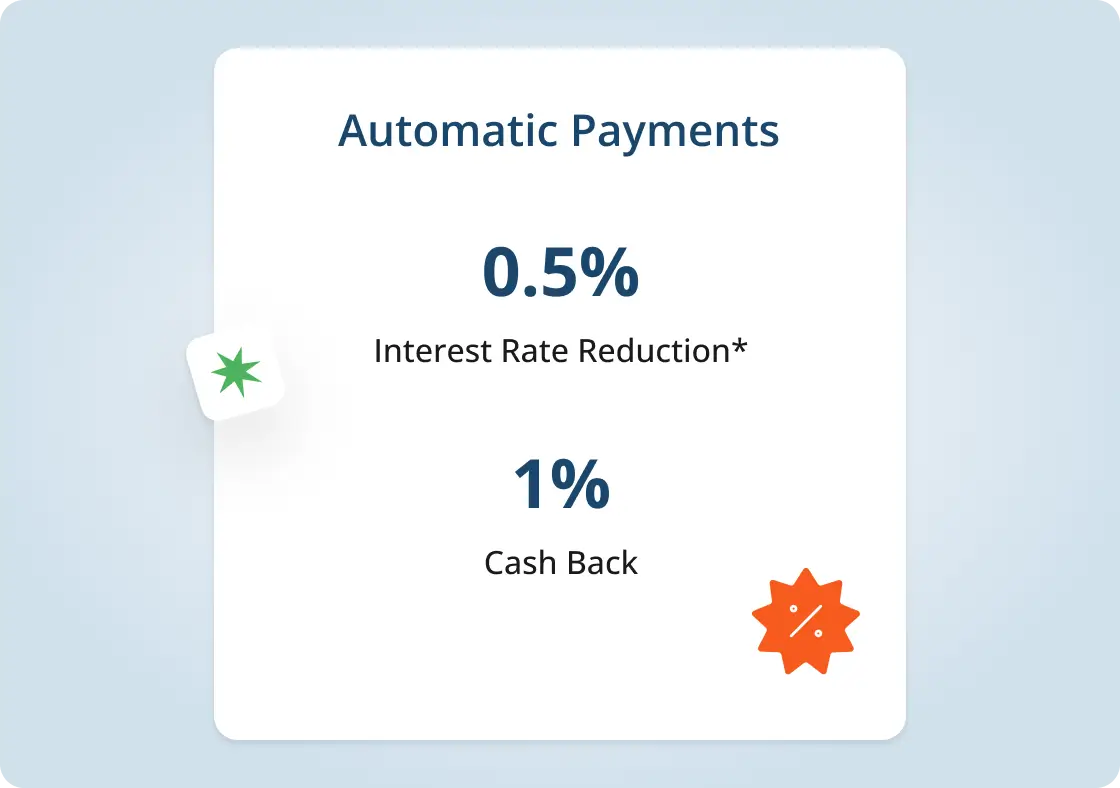

0.5% Automatic Payment Discount applied when eligible borrowers are making automatic payments on their Ascent Non-Cosigned Credit-Based student loan via auto-debit from their personal checking account*.

1.00% Automatic Payment Discount applied when eligible borrowers are making automatic payments on their Ascent Non-Cosigned Outcomes-Based student loan via auto debit from their personal checking account.

1% Cash Back Graduation Reward upon satisfaction of certain terms and conditions.

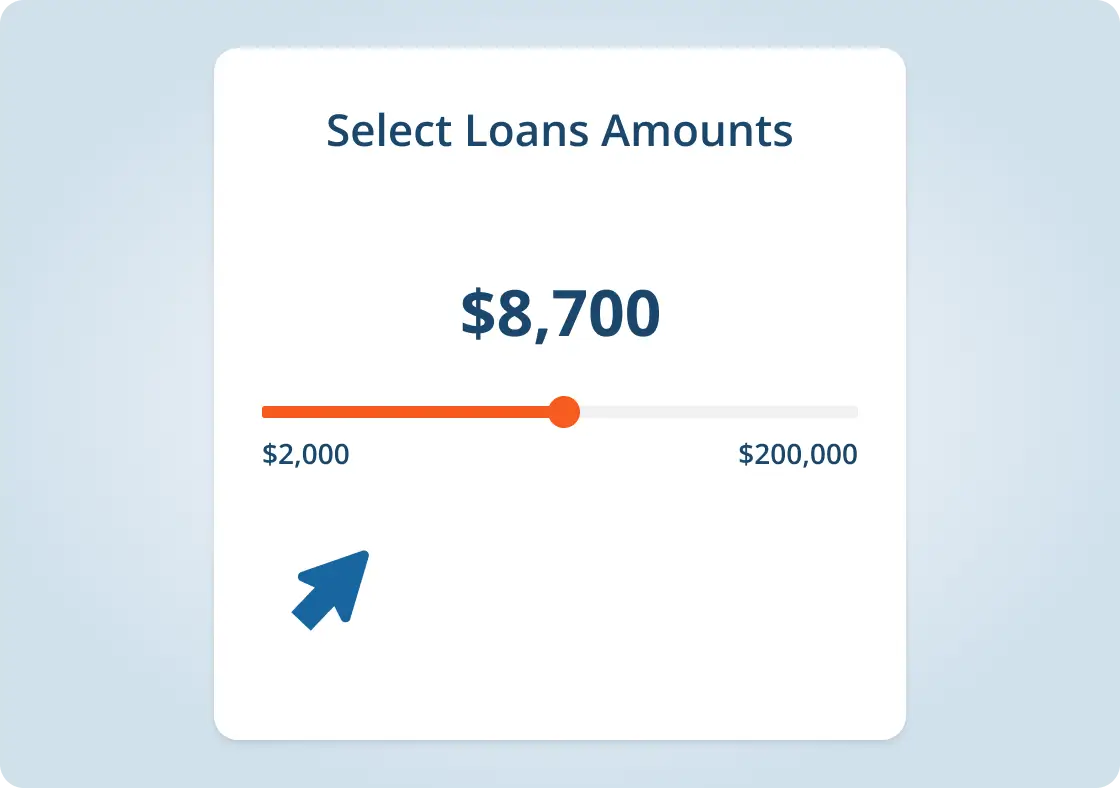

Minimum: $2,001*

Maximum: $200,000 for Non-Cosigned Credit-Based Loan; $20,000 for Non-Cosigned Outcomes-Based Loan ($200,000 aggregate total)

NOTE: Because the Non-Cosigned Outcomes-Based Loan is available to students without any reliance on cosigners, processing times may be longer and loan amounts may be lower than the loan amount requested.

*The minimum loan amount is $2,001 except for the state of Massachusetts. Minimum loan amount for borrowers with a Massachusetts permanent address is $6,001.

You’re eligible for an international student loan with Ascent if:

In addition to the above requirements, international students attending U.S. universities are also required to have a creditworthy cosigner for Ascent student loans.

Your cosigner must:

An I-20 is one of the documents we will require to fund your education. If you do not have an I-20 yet or are planning on using Ascent as your proof of funding, we can help!

Stay focused on your goals – we’ll cover the expenses. From books to bills, Ascent student loans can pay for exactly what you need. Borrow as little as $2,001† up to your full cost of attendance so you can keep moving forward.

Start an Application†The minimum loan amount is $2,001, except for the state of Massachusetts. The minimum loan amount for borrowers with a Massachusetts permanent address is $6,001. Your maximum loan amount will be determined according to Ascent's Ts&Cs and your school's certification of the loan amount.

For international undergraduate students with a creditworthy cosigner

(No penalty for early repayment)

For international graduate students pursuing their MBA with a cosigner.

(No penalty for early repayment)

For international graduate students pursuing their MD, DO, DVM, VMD, or DPM with a cosigner.

(No penalty for early repayment)

For international graduate students pursuing their DMD or DDS with a cosigner.

(No penalty for early repayment)

For international graduate students pursuing their law degree with a cosigner.

(No penalty for early repayment)

For international students seeking graduate loans for degree programs in allied health, nursing, pharmacy, PhD programs, and other advanced graduate degrees (MA, MS) with a cosigner.

(No penalty for early repayment)

For parents, grandparents, guardians, and sponsors with an international student attending an eligible school.

(No penalty for early repayment)

You’ve already put a lot of work into preparing for college.

We ask you to provide important information such as your name, address, date of birth, the school you’re applying to, and employment information. If you’re applying with a cosigner, they’ll also enter their information.

Once your completed loan application is approved, you’ll be able to view your loan details and select the loan terms that work best for you.

After you choose your loan terms, complete any loan application tasks in your Ascent portal.

When your portal tasks are complete, we send your loan for school certification. Once certified, we’ll disburse your loan directly to the school.

In addition to a creditworthy cosigner, international students attending a university in the U.S. must be able to verify your individual resident status and provide proof of identification:

A valid visa must not expire within 6-months of the end of the enrollment period for which the loan is being requested. Acceptable forms are as follows:

AND Social security card

(in lieu of unexpired VISA and Social Security Card):

(pages 1 & 2 signed - if applicable)

AND

Unexpired Passport

from country of origin

See here for eligible Temporary Protected Status countries

An I-20 is one of the documents we will require to fund your education.* If you do not have an I-20 yet or are planning on using Ascent as your proof of funding, we can help!

If you have a U.S citizen or U.S permanent resident cosigner and are conditionally approved, we will issue you a conditional approval letter, which you can take to your visa appointment. Once you’re approved for the I-20 documentation, you can upload your documentation in your Ascent portal and proceed with your loan application.

*Note: We do not accept all visa types. Please see above for eligible visa types.

Eligible international students with no credit score or eligible students that meet a minimum credit score must apply with a cosigner. The minimum score required is subject to change and may depend on the credit score of your cosigner.

of credit-based college loan borrowers increased their credit score1

minutes of financial wellness education accessed

scholarships awarded by Ascent since 2020

Ascent funding has the strategy that makes loan applications accessible to international students. This is the best of all. So optimal and appreciated.

Easy to navigate, easy for you to understand, easy to fill up the forms and very organized, also super happy that they include international students

I've had such a struggle finding a loan and Ascent made it so simple. Not only was the process a weight lifted off my shoulders, but also ensured that I understood more about loans in general.

From your first application to your final payment, we’re committed to helping you every step of the way. Our 100% U.S.-based Customer Service Team is here for you.

Call us toll-free at 877-216-0876

Email us at [email protected]

Ascent is an innovative private student loan program that provides access to higher education funding for an expanded population of undergraduate and graduate students, while encouraging the financial wellness of students and their families.

We advocate awareness of the potential financial outcomes of your higher education choices (school, major, years in school, financing your education), helping you visualize where your career could go and what it could be – encouraging better decisions today to open up greater future opportunities.

Ascent offers loan products to help international undergraduate and graduate students pay for college.

International undergraduate and graduate students have the option to apply for a Cosigned Credit-Based Loan. Ascent created customized grad school loans for:

*Annual Percentage Rates (APRs) displayed above are effective as of 02/05/2026 and reflect an Automatic Payment Discount of 0.25% on credit-based college student loans submitted prior to 06/01/2025, a 0.5% discount on credit-based college student loans submitted on or after 06/01/2025, and a 1.00% discount on outcomes-based college student loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower's credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.

**Over 168,000 borrowers took out an Ascent loan for college or career training tuition or expenses between January 2018 and November 2025.

1Impact to score may vary. For some, scores may not improve. Results will depend on many factors, including on-time payment history, the status of non-Ascent accounts, and other financial history.