A loan that fits your needs

We offer multiple repayment plans, so you can choose what works best for you! Pre-qualify in minutes to compare your options and preview your payments.

Start an Application

Fixed APRs starting at

3.09%*

115,000+ people have used Ascent to pay for school**

We offer multiple repayment plans, so you can choose what works best for you! Pre-qualify in minutes to compare your options and preview your payments.

Start an Application

Can You Get a Student Loan Without a Cosigner? Understand your options—and how to qualify solo or with support.

Cosigning a student loan isn’t just support—it’s a stepping stone to opportunity. Understand the responsibilities and rewards of becoming a cosigner.

Cosigning helps students access education—and may boost your credit, too. Discover the potential upsides of becoming a cosigner.

Every student’s situation is different, so if you can’t qualify for a loan in your own name, our private student loans with a cosigner can help.

Preparing for college is hard work, but applying for a cosigned student loan is fast and easy.

We ask you to provide important information such as your name, address, date of birth, and employment information, as well as some information about your student.

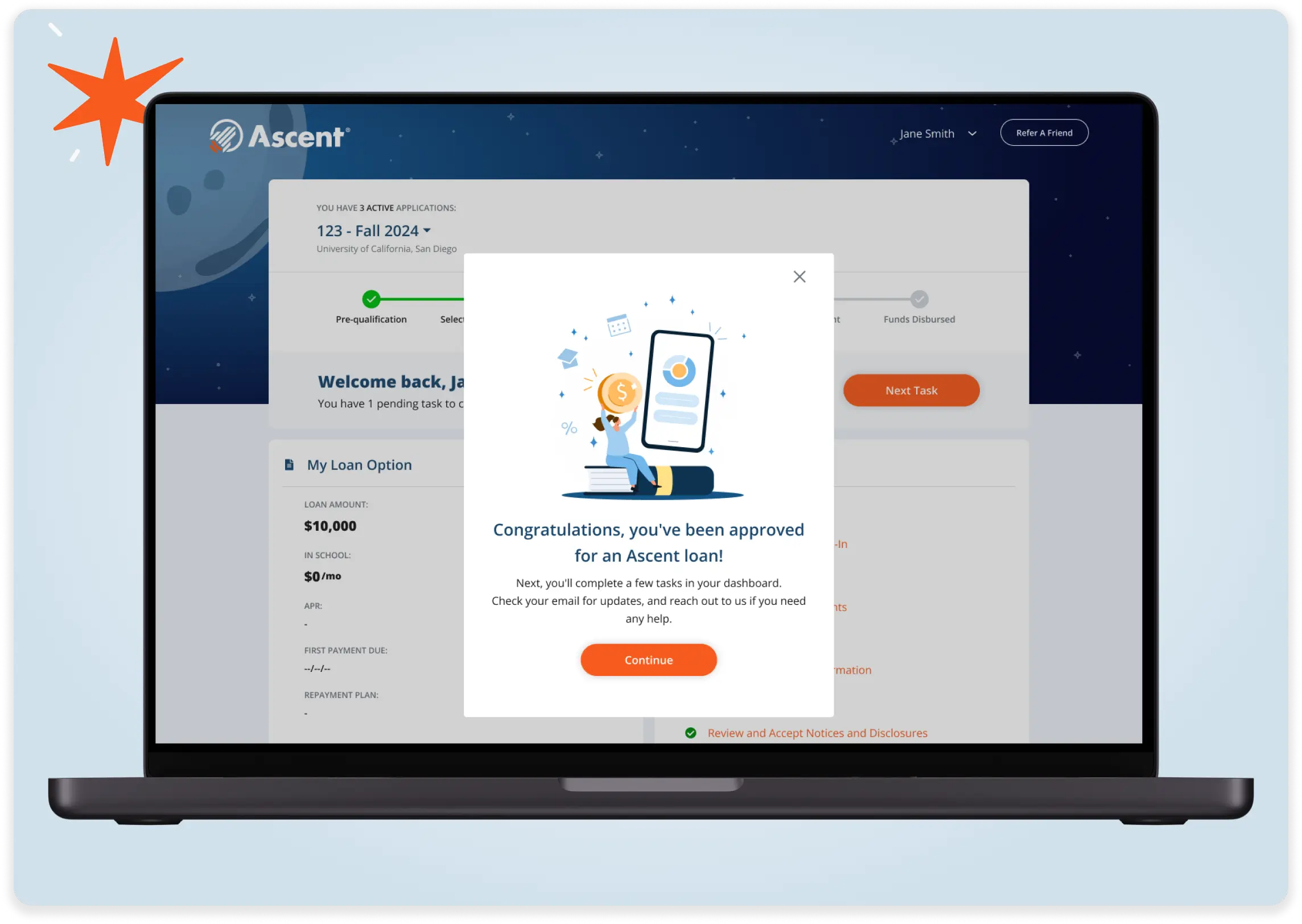

Once your completed loan application is approved, you'll review your loan details and select the loan terms that work best for you.

After you choose your loan terms, complete any loan application tasks in your Ascent portal.

When your tasks are complete, we’ll send your loan for school certification. Once certified, we’ll disburse the funds directly to the school.

Check your rate today without impacting your credit score.

Apply Nowof credit-based college loan borrowers increased their credit score

minutes of financial wellness education accessed

scholarships awarded by Ascent since 2020

Possibly the easiest process I have ever gone through in order to secure a loan.

Everyone was so helpful and nice to work with! Being a first generational College student picking a loan was scary and nerve wracking! but they made it so easy!

I've had such a struggle finding a loan and Ascent made it so simple. Not only was the process a weight lifted off my shoulders, but also ensured that I understood more about loans in general.

Check your rates without impacting your credit score.

From your first application for a private student loan with a cosigner to your final payment, we’re committed to helping you every step of the way. Our 100% U.S.-based Customer Service Team is here for you.

A cosigner agrees to become legally responsible to make your student loan payments if, for whatever reason, you are unable to in the future, so it’s important to choose someone who is reliable and meets the eligibility requirements.

Here are a few common types of cosigners:

Yes. You can apply to release your cosigner after making the first twelve (12) consecutive, regularly scheduled full principal and interest payments on-time and meeting the other eligibility criteria to qualify for the loan without a cosigner, including meeting the program requirements for a solo student borrower. The student borrower must make the request to release a cosigner directly with Launch Servicing or the loan holder. For full eligibility requirements, visit our Borrower Benefits page.

Note: The option to apply to release the cosigner is only available to student borrowers who are a U.S. citizen or U.S. permanent resident and is not available to students who are not a U.S. citizen or U.S. permanent citizen.

Ascent’s credit decisioning criteria is proprietary and subject to change, but you can check what rates you pre-qualify for in just four (4) steps without impacting your credit score. We consider credit history and several other factors including, but not limited to, credit score:

Cosigned Credit-Based Loan

Loans subject to individual approval, restrictions and conditions apply. See Terms and Conditions at AscentFunding.com/Rates and AscentFunding.com/Ts&Cs. Loan features and information advertised are intended for Ascent college student loans and are subject to change at any time.

*Annual Percentage Rates (APRs) displayed above are effective as of 07/01/2025 and reflect an Automatic Payment Discount of 0.25% on credit-based college student loans submitted prior to 06/01/2025, a 0.5% discount on credit-based college student loans submitted on or after 06/01/2025, and a 1.00% discount on outcomes-based college student loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower’s credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.

**Over 115,000 borrowers took out an Ascent loan for college or career training tuition or expenses between January 2018 and November 2024.

1Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

2Ascent’s 1% Cash Back Graduation Reward is for eligible college students only and subject to terms and conditions. Eligible students must request the graduation reward from Ascent. Learn more at AscentFunding.com/CashBack. 1% Cash Back Reward amount dependent upon total loan amount for Ascent college loan borrowers; approximately $365 average reward amount based upon eligible borrowers who received Cash Back Rewards in 2023. Aggregate cash back limit of $500.

Our lowest college loan rates of the year—starting at 3.09% APR*—are only here for a short time.

Lock in your best rate before they’re gone!

Even better? You can check your college loan rate in 3 minutes with no impact on your credit score.