Smart Money Moves: The Ultimate Guide to Budgeting for College Students

Categories: For College Students, For Grad Students, For High School Students, For Students

College is an exciting time to explore, grow, and gain independence—including getting comfortable with money. Budgeting might sound intimidating, but it’s really just a way to make sure your money supports the life you want to live. With the right strategy and tools, any student can manage money effectively, reduce stress, and set themselves up for future financial success.

Why Budgeting is Crucial for College Students

Budgeting gives you control over your money, even when it feels like you don’t have much. It helps you cover essentials, avoid debt, and still enjoy life on and off campus. Whether you’re managing a part-time income or student loans, a budget keeps you organized, prepared for surprises, and builds good habits for life after college.

Step 1: Understand Your Finances – Creating a Realistic Budget

Before you can build a budget that works, you need to understand where your money is coming from and where it’s going. Taking the time to get clear on your income, expenses, and savings goals is the foundation of smart money management.

Track Your Income Sources:

Before you can plan how to spend or save, it’s important to know how much money you have coming in. Identifying all your income sources will give you a clear starting point for your budget.

- Financial aid (grants, scholarships, loans)

- Job income

- Family support or allowance

Know Your Expenses: Prioritize Needs vs. Wants

Once you understand your income, the next step is to track your spending. Breaking your expenses into needs and wants can help you make smarter decisions about where your money goes.

- Fixed Expenses (Needs): Tuition, rent, utilities, insurance, credit cards, bills

- Variable Expenses (Wants): Food, entertainment, supplies, clothing, personal care

Savings: Fund Your Future

Saving might not feel urgent right now, but it’s one of the most powerful habits you can start. Even small contributions help you build a financial safety net and encourage long-term habits that will support your goals well beyond college.

- Savings Accounts: Emergency Fund, travel expenses, pet care

- High Yield Savings Account: Have higher interest rates and enable faster growth of your savings

- Retirement Plans (401k, Roth IRA): Tax-advantaged savings plans to help grow savings over time for retirement expenses

Use a Budgeting Method

Choosing a budgeting method gives structure to your financial plan and helps you stay consistent with your spending, savings, and goals.

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt repayment

- This rule helps individuals manage their finances by prioritizing essential expenses, discretionary spending, and long-term financial goals.

- 50% Needs: Essential expenses you must pay to live and work

- 30% Wants: Non-essential but enhance quality of life

- 20% Savings: Strengthening your financial future

- Envelope Method: Physical or digital envelopes for each category

- Determine budget categories

- Set monthly budget for each

- Withdraw cash and fill envelopes

- Spend only from those envelopes

Step 2: Save Where You Can

Once you’ve built a basic budget, the next step is finding ways to stretch your dollars further. The good news? As a college student, there are tons of easy ways to save without sacrificing fun or convenience. From student discounts to smart spending habits, a few small changes can make a big difference. Here’s how to make the most of what you have.

- Student discounts: Show student ID at restaurants, shopping stores, movie theaters, etc.

- Apps to get student discounts: UNiDAYS, Student Beans

- Textbooks: Rent, buy used, library copies

- Food: Cook at home, use meal plans wisely, avoid daily coffee shop habits, check supermarket ads for deals

- Transportation: Use public transit, bike, or carpool

- Most colleges provide free transportation passes

- Entertainment: Attend free campus events, share streaming accounts

Step 3: Prepare for the Unexpected

Even the best budgets can be thrown off by surprise expenses. Whether it’s a last-minute trip home, a medical bill, or an extra textbook you didn’t plan for, life happens. That’s why it’s important to build a financial cushion that helps you handle the unexpected without stress—or debt. Here’s how to stay prepared and protect your budget.

- Build an Emergency Fund: Aim for a $500 goal to start

- Plan for Irregular Expenses: Books, holidays, trips, birthdays, medical expenses

Step 4: Use Tools to Stay on Track

Creating a budget is a great start—but staying on track takes a little help. Thankfully, there are plenty of simple tools that can keep you organized and consistent, even on your busiest days. Whether you prefer apps, spreadsheets, or calendar reminders, the right tools can make managing your money quicker, easier, and less stressful. Let’s look at a few that can help you stay in control.

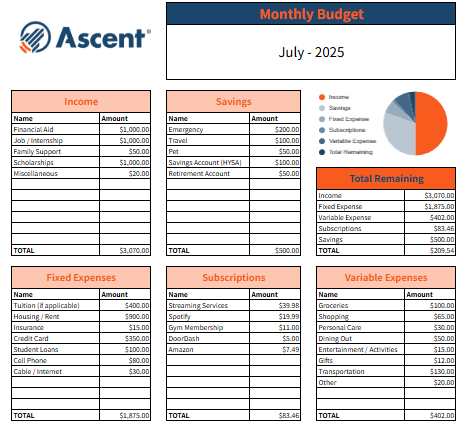

- Spreadsheets: Custom Google Sheets or Excel

- Download Ascent’s Student Budgeting Sheet here!

- Banking Tools: Auto alerts for low balance, spending summaries

- Calendar Reminders: For bill due dates and budget check-ins

- Block specific date/time on your calendar to sort your finances

Common Budgeting Mistakes to Avoid

Even with the best intentions, it’s easy to slip up. Being aware of common budgeting mistakes can help you stay on track and avoid unnecessary stress. Here are a few pitfalls to watch out for:

- Underestimating daily spending: Every purchase adds up!

- Not reviewing your budget monthly: Adjust for changes

- Overlooking one-time costs: Move-in costs, graduation fees, etc.

- Relying on your credit cards: Make sure you have the funds to pay them back

Building Healthy Financial Habits

Good budgeting isn’t just about numbers—it’s about building habits that support your goals over time. With a few consistent practices, managing your money can become second nature. Here’s how to turn smart choices into lasting habits:

- Track every dollar: Even small purchases add up

- Set time aside time to review your account weekly

- Set your goals: avoid overdrafts, reduce credit card use

- Stick to your budget for 3 months? Treat yourself (responsibly)!

Final Thoughts

Budgeting is an essential skill that can make your college experience less stressful and more empowering. It’s not about getting everything right the first time—it’s about starting small, staying flexible, and learning from your experiences. With a little effort and consistency, you’ll build habits that not only help you thrive in college but also set you up for long-term financial success.