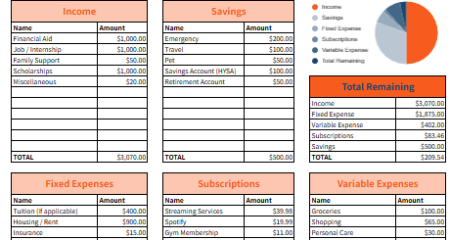

Smart Money Moves: The Ultimate Guide to Budgeting for College Students

College is an exciting time to explore, grow, and gain independence—including getting comfortable with money. Budgeting might sound intimidating, but… Read More

A Student’s Guide to Smart Summer Spending & Saving

It’s finally summer! Whether you’re kicking off your mornings with a run, gaming with friends, or soaking up the sun… Read More

Ascent Named Best Places to Work in Fintech 2025

For the fourth year, San Diego-based fintech recognized for innovative culture Ascent, a leading provider of innovative financial products and… Read More

The Forward Fund, NCAHEC and Ascent Funding Partner to Tackle North Carolina’s RN Shortage

North Carolina’s nursing shortage is projected to reach nearly 12,500 by 2033. To address this shortage, The Forward Fund (TFF)… Read More

What to Do After College: A Practical Guide for Life after Graduation

Graduation is coming up soon, and with it comes a big question: What now? By now, you’re used to attending… Read More

Navigating Education Evolution: An Ask Me Anything session with Ascent’s CEO Ken Ruggiero

Education is always evolving, and keeping track of the changes can be overwhelming. From critical FAFSA updates to new Department… Read More

Do You Need a Cosigner for Student Loans?

Not sure if you need a cosigner for your student loans? Learn more about the different factors you should consider… Read More

What to Do if You Can’t Get a Cosigner for a Student Loan

Wondering what to do if you can't find a cosigner to cosign your student loan? Read about five options you… Read More

Does Cosigning a Student Loan Affect My Credit?

The Credit Impact To Cosigning a Student Loan If you’re wondering how cosigning a student loan affects credit, the answer… Read More

How Parents or Guardians Can Help Their Child Get a Student Loan

As a parent or guardian of a college-bound student, it’s important to ensure your child is financially prepared to cover… Read More