How to Start Investing in College: 6 Easy Steps

At Ascent, we provide free resources to help you throughout college, which is intended to be for informational purposes only and may include links to third-party websites (where security and privacy policies may differ from Ascent’s). For our full disclaimer, please click here.

Your rent is paid, your fridge is stocked, and bills are covered; you’re probably wondering what to do with the extra cash (if you even have any). Save it? Shop ‘til you drop? Enjoy a night with friends? The possibilities seem endless – the hard part is figuring out which route to take.

College is also a great time to learn how to start investing. Even with just a little extra cash ($20 or $30), you can begin to build a portfolio. Just remember, the art of investing comes with its share of risk.

Here are 6 steps (including student-friendly apps) to answer questions you might have on how to start investing in college.

Step 1: Understand why investing early is important.

The earlier you start investing (whether in high school, in college, or after graduation), the more time you have for your money to grow. You may not have a million dollars to invest now, but thanks to the beauty of compound interest, starting to invest early (even with a small amount) can help your money grow over time.

For example, if you worked this summer and saved $1,000, you might consider investing it. After a year, you may find your $1,000 turned into $1,080.

If you’re wondering how to start investing in college, The College Investor makes it easy for you to see how you could become a millionaire by the time you turn 62 by investing $2,100 per month starting at age 18.

It’s important to note though – with compound interest, it’s not about when to invest (or trying to understand the market), it’s about your time in the market. So, get started as soon as you can.

Step 2: Find a discount broker (free or at a low-cost).

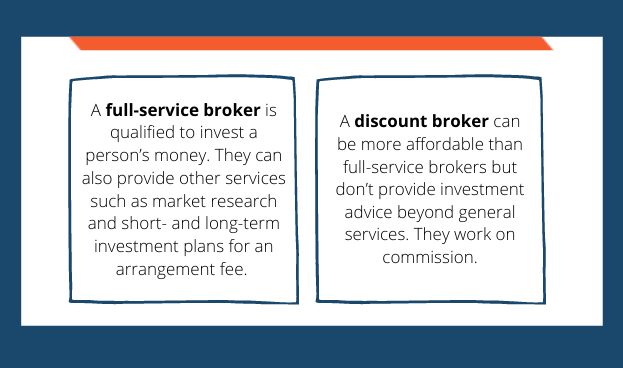

To find a broker, you must first understand what a broker is:

If this is your first time exploring the world of investing, you and your budget may want to start with a discount broker. You can easily find discount brokers online, but according to Nerdwallet, two popular sites are Interactive Brokers and TD Ameritrade. Both these platforms make it easy for you to start investing in college by offering low-cost investment opportunities with no commission costs*.

Step 3: Get started with an investing app.

If you want to get comfortable with investing before finding a discount broker, you can get started on your own by downloading an affordable investment app.

Apps like Robinhood make it easy to help you start investing in college (commission-free) for just $1. Other apps like Acorns, can help by rounding up the spare change from your everyday purchases like coffee and food. Find an app that works for you and get started (and remember to check user reviews)!

Step 4: Be consistent every month.

Once you find a discount broker or investing app, you can invest your money with no added commission fees*. If you can manage it with your budget, dedicating at least $20 or $30 every month to investing long-term can help you earn more in the long run and stay motivated to monitor market trends.

Any little bit you can dedicate to investments can go a long way to start building your portfolio. Undoubtedly, the coronavirus has impacted our economy, but if you find you have the time and resources it’s still essential to learn how to start investing in college.

Step 5: Plan for your future.

As you become more comfortable with investing, you might start to consider planning ahead and invest your earnings into a retirement account. An Individual Retirement Account (IRA) is a tax-advantaged investing tool you can use to allocate funds for your retirement.

The benefit of opening an IRA is it allows you to defer taxes on any of your investments to help you save even more money when tax season comes around. It may sound crazy to start planning for your retirement when you’re still in college or recently graduated, but the more you can learn now, the more you can earn for your retirement, and the more you will understand the retirement benefits future jobs may provide.

Step 6: Understand key investment terms.

To start investing in college, you must understand key investment words you’ll run into as you do your research.

Here are a few terms from Investopedia to become familiar with first:

- Broker: Negotiator between an investor (you) and securities exchange (see definition below)

- Stock Exchange: Marketplace where brokers can buy and sell stocks and bonds

- Bonds: Units of corporate debt issued by a company and confirmed as tradeable assets

- Stock: Security that represents the ownership of a fraction of a corporation through shares

- Shares: Units of ownership in a corporation that provide equal distribution of any profits in the form of dividends

- Shareholders: the owner of shares in a company

- Dividends: Distribution of a portion of a company’s earnings to a class of its shareholders

- ETF: (Exchange Traded Fund) Bundle of securities that trade on an exchange and contains all types of investment like stocks, commodities, or bonds

- Commodities: Basic good used in commerce that is interchangeable with other goods of the same type

- IRA: (Individual Retirement Account) is a tax-advantaged investing tool that individuals use to determine funds for retirement savings

- 401K: Plan is a tax-advantaged, defined-contribution retirement account offered by many employers to their employees

- Roth IRA: Individual retirement account (IRA) that allows qualified withdrawals on a tax-free basis provided certain conditions are satisfied

You don’t need to memorize these just yet (so put your flashcards away), just keep an eye out for any new terms that may come your way.

If you feel that your budget allows and you’re wondering how to start investing in college, make sure to put yourself in an investor’s shoes and continuously do your market research given the real risks involved, and understand it takes time to learn the art of investing.

For more tips on how to budget your money, please visit the link below.

*No commission on certain investment and transaction types. See each platform’s pricing structure for more details.