A Guide to Filing Taxes as a College Student

You did it! You made some money from an internship or part-time job over the last year. Now it’s time to file your federal and state income taxes. For the year 2023, several states including California, Georgia, and Alabama have extended their tax deadline to October 16, 2023. For all other states, this year’s tax deadline falls on April 18, 2023, so make sure you mark your calendar.

As scary as the word “taxes” may sound, it’s never too early for you to learn to do your own taxes, and you might even get some extra dollars in your pocket. If this is your first time filing your taxes on your own, here’s a beginner’s guide from one of our student interns on how to better prepare yourself when filing your taxes.

Step #1: Do College Students Need to File Taxes?

According to U.S. News, as a full-time college student, you may not have to file your income taxes this year. According to H&R Block, if you were single (not married) and earned less than $12,950, you don’t have to file a federal income tax. If you earned more than $12,950 in 2022 from jobs, financial investments, or some other source of income, – like selling stocks – then you will need to file your income taxes.

However, as a student, even if you made less than $12,950 in 2022, you might want to file your income taxes to take advantage of your withholding tax benefits. According to Investopedia, withholding tax benefits is, “the amount an employer withholds from an employee’s wages and pays directly to the government. By filing your taxes, you may receive your withholding tax benefit as a part of your federal and state tax returns, which means you might get some money back.

Step #2: Where Should I File My Taxes?

After deciding to file your taxes, there are a handful of companies to choose from. Companies such as H&R Block, TurboTax, Credit Karma, and Jackson Hewitt advertise that they provide tax services at an affordable cost. Another option is to file your taxes directly on the IRS website here. According to the same U.S. News article we mentioned before, the IRS Free File will allow you to file your taxes for free online on any of their listed partners’ pages if your adjusted gross income was $73,000 or less. Whichever platform you choose, they should be able to guide you through each step of the process to make sure you fill out the correct forms and documents.

Whether you choose to file your taxes using a private company or directly with the IRS, it’s important to know that you are essentially completing the same forms regardless of the platform and you should consider all options and choose the one that you feel works best for you.

Step #3: Required Documents for Filing Taxes as a Student

You’re halfway through preparing your own taxes as a student!

Once you’ve decided which platform you’ll use to file your taxes, you need to prepare all the essential documents. Here are some items you might need as listed on the IRS website:

- Photo ID

- Your Social Security Number or ITIN (Individual Taxpayer Identification Number)

- Proof of foreign status if applicable and you are in need of an ITIN

- Any W-2’s you may have. You should have received one from each employer!

- Any 1099 forms you may have.

- Routing and account numbers for direct deposit.

- Health Insurance Exemption Certificate if you possess one.

- Any 1095 forms if you’ve received them.

- An unemployment form if applicable.

Once you have obtained all the required forms specific to your situation, you can start the filing process in one of the ways shown on the previous tip!

Step #4: I’m Ready to File – What’s Next?

Once you have all your necessary documents at hand, now it’s time to fill out the forms.

Whether you are using a third-party platform or the IRS free tax filing tool, you can start your application by filling out necessary boxes according to your tax documents.

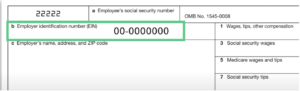

For example, take a look at the image below:

This section asks for the employee identification number (EIN) or Federal ID and the employer’s name. The words “Box b” and “Box c” on the left side of the description indicate this information’s location on your W-2 form. Refer to your W-2 form that corresponds with the specific employer and look for boxes “B” and “C”.

You will need to do this with every field you need to fill out. If your W-2 or other forms do not provide a specific amount, you may skip them and the system should automatically assume the information is not available so you can continue moving through the application.

Make sure to take your time when filling out these forms. Small errors can cause long delays in getting your tax return if you are qualified for one.

Step #5: Yay! I Finished Filing. When Can I Expect My Refund?

Once you have finished your application, you want to make sure that your documents are submitted completely. Pat yourself on the back for being able to file your taxes and be prepared to do it again next year. If you provided bank information or mailing address, the IRS will send your tax return. Remember to keep a copy of your taxes, as well. It’ll come in handy when you have to file again next year.

Bonus Tip: Where do I go if I have any questions?

If you have any questions regarding your tax return, you may ask a professional, mentor, or go to the IRS website to ensure that your information is correct. Online platforms like TurboTax and Intuit also have online chat bots that can help answer any questions along the way.

You can also reach the IRS by phone according to the type of questions that you have as listed here.

For more information regarding student loans, visit our homepage.

For even more tax tips, visit our blog post below.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.