Finding a Cosigner for Your Student Loans

Researching and applying for student loans can be challenging. You may come across the term “cosigner” in your research without fully understanding what a cosigner is or why you need a cosigner.

Depending on your eligibility to qualify for a loan on your own, some lenders may require you to add a cosigner to share the financial responsibility of your student loan. As a cosigner, they’re equally responsible for making payments if you are unable to in the future.

Finding a cosigner isn’t required, but it may be a good option if you don’t qualify for a loan on your own for the total amount you need. Applying with a creditworthy cosigner may also help you qualify for a lower interest rate.

Below we’ll go over our tips on how to find a cosigner.

Why Cosigners for Student Loans Are Important

Having a cosigner may give your lender more assurance that the loan will be repaid. If you have no credit or poor credit, finding a cosigner can make it possible to get a student loan. Having a cosigner may also give you a better interest rate.

Qualifications and Requirements of a Cosigner

Generally, a cosigner must be 18 years or older and a U.S. citizen or permanent resident who meets the credit criteria the lender sets. These criteria typically include meeting a minimum credit score, credit history, and income level.

To give an example of what this may look like, let’s consider the Cosigned Credit-Based Loan from Ascent. Some cosigner requirements include (but are not limited to):

- Being at least 18+ years old (or the age of majority), and a U.S. citizen or permanent resident.

- Having more than two (2) years of credit history.

- Meeting a minimum credit score (which is subject to change).

- Earning a minimum gross annual income of $24,000 for the current and previous year and submitting proof of income.

If your potential cosigner meets these criteria, they may be eligible to support you by cosigning your student loan.

4 Tips for Finding Your Student Loan Cosigner

Finding a cosigner for a loan can be challenging, even if you have an amazing support system. Here are four tips to help you find and secure the right person to cosign your student loan.

1. Be Ready for the Conversation

When asking a friend or relative to be a cosigner, you must show them that you’re serious about your education and understand what it means to have a student loan. They’ll be more likely to become a cosigner if they know you’re going to be the primary person making payments.

To ensure our students are successful, we include learning how to budget responsibly and financial education in our application process.

Here are some other things you should mention to your potential cosigner to assure them:

- You have a repayment plan.

- You understand the pros and cons of cosigning. They’ll see you’re doing the research AND learn what it means to cosign.

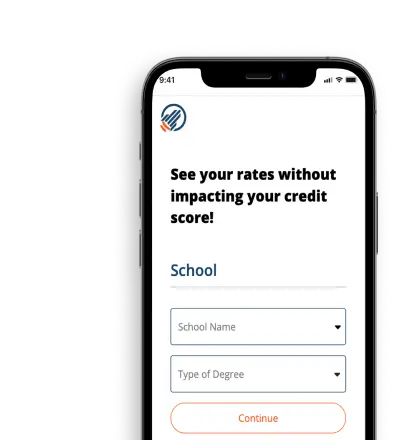

- You understand the eligibility requirements and that lenders like Ascent allow you to check your rates without a hard credit check.

- You understand that Ascent and other lenders allow you to release your cosigner from their obligation once you meet certain conditions.

With Ascent, you may have the option to release your cosigner after making twelve (12) consecutive entire principal and interest payments on time or an equivalent prepayment amount while also meeting the other eligibility criteria to qualify, including, but not limited to meeting specific minimum credit and income requirements and completing a Cosigner Release application. See full eligibility criteria requirements at AscentFunding.com/BorrowerBenefits. Once you’ve released your cosigner, you’ll have greater independence and financial freedom.

2. Start with Family

Your cosigner should be someone who meets the eligibility requirements and genuinely believes in you. They should be someone who wants to support your future and is excited to cheer you on throughout your path to graduation.

That’s why we suggest starting with family. There is also trust involved in cosigning a loan. A family member who knows you, supports you, and trusts you are more likely to agree to become a cosigner.

The good news is that a cosigner doesn’t need to be related to you. However, it’s common for cosigners to be parents, legal guardians, grandparents, aunts, uncles, or other adult relatives.

When finding a cosigner for your student loan, remember that you can only have one. If you have two parents or family members willing to cosign for you, you will only need one

3. Find a Cosigner from Your Wider Circle

If you cannot ask family for whatever reason, think of a trusted friend or mentor who has been there for you and wants you to succeed in achieving your goals. They can be a close friend or mentor you can reach out to. A friend or mentor may be willing to take on the financial obligations of cosigning for you.

Ensure you include them in the entire process and be open about your financial situation and repayment plans

4. Consider the Alternatives

Suppose you feel uncomfortable asking someone to be a cosigner. There are other things you can do. For instance, you can ask to borrow money directly from them. If they have the means to pay for your college, you can draw up a loan agreement with terms that both of you are comfortable with.

Another option is to consider a less expensive school. You may choose to attend a community college after high school. You could get scholarships to other schools later if you receive decent grades.

What to Do if You Can’t Find a Cosigner

If you’ve exhausted all your options for finding a cosigner, there are still things to consider. You could apply for a private student loan with no cosigner. If you are an eligible undergraduate junior or senior, you may qualify for an Ascent Outcomes-Based Non-cosigned Loan. Learn more about how to get a student loan without a cosigner or explore additional types of loans for students that might help you.

Read More Tips on Student Loans

We’re here to support you no matter your college dreams. We have various resources available to help you on your journey and are here to answer any questions. Check out our blog for more tips.

FAQs About Finding a Student Loan Cosigner

How can I pay for college?

You can pay for college with scholarships, grants, private and federal student loans, or out-of-pocket. Many students pay for college with all the above.

What is a student loan cosigner?

A student loan cosigner is a trusted adult and U.S. citizen or permanent resident with a good credit history. They are responsible for paying your student loan if you cannot pay for any reason.

Why would I need to find a student loan cosigner?

You may need a student loan cosigner if you don’t qualify for a loan on your own or if the terms and rates you are eligible for do not fit your needs.

Does my cosigner need to be my parent?

Your student loan cosigner does not need to be a parent or guardian. You can use any adult who meets your lender’s qualifications.

How do I find a cosigner?

Look for student loan cosigners within your circle of family and friends first. If those don’t work out, talk to your school about options.