How to Calculate Student Loan Interest: A Step-by-Step Guide

Categories: Blog, For Bootcamps, For College Students, For Cosigners, For Grad Students, For High School Students, For Parents and Cosigners, For Students, Uncategorized

Understanding how student loan interest works and how it’s calculated can help you manage your debt more effectively–and potentially save you money. Staying informed and making smart decisions about your student loans can help you invest in your education without sacrificing your financial future.

Understanding Student Loan Interest

When you take out a student loan, you’re not just borrowing the amount you need for school; you’re also agreeing to pay interest, a cost calculated as a percentage of the principal amount. Interest is essentially the price you pay for the opportunity to borrow the money. Understanding how interest is calculated on student loans is crucial for managing your debt and planning your financial future.

Interest on student loans is typically calculated daily and added to your loan balance monthly. The amount of interest you owe depends on your loan’s interest rate, the amount of your loan, the time it takes to repay it, and other loan terms. Generally, the longer you take to repay your loan, the more interest you’ll pay.

Types of Student Loan Interest

The primary types of student loan interest are fixed and variable. Let’s take a deeper look at the two and how they differ.

Fixed Interest Rate Loans

Fixed interest rate loans have an interest rate that remains the same for the life of the loan. This means your monthly payments will be predictable, and you’ll know exactly how much you’ll pay over the loan term. Federal student loans typically have fixed interest rates, not based on credit score or financial history, but are set by law.

Variable Interest Rate Loans

Unlike fixed-interest rate loans, variable interest rates fluctuate over time to mirror market conditions. Variable interest rates are typically tied to a financial index and can rise or fall based on the current market interest rates. While variable rates are sometimes lower than fixed rates, they’re also less predictable. If rates increase significantly, so could your monthly payment and total loan cost.

Differentiating Principal and Interest Payments

When you make a payment on your student loan, it’s applied to both the principal and the interest. Initially, a large portion of your payment goes toward the interest. Over time, as the principal balance decreases, more of your payments are applied to the principal. Understanding this concept can help you make informed decisions about how to calculate interest on student loans and how extra payments or a different repayment plan might affect your total cost.

Steps on How to Calculate Student Loan Interest

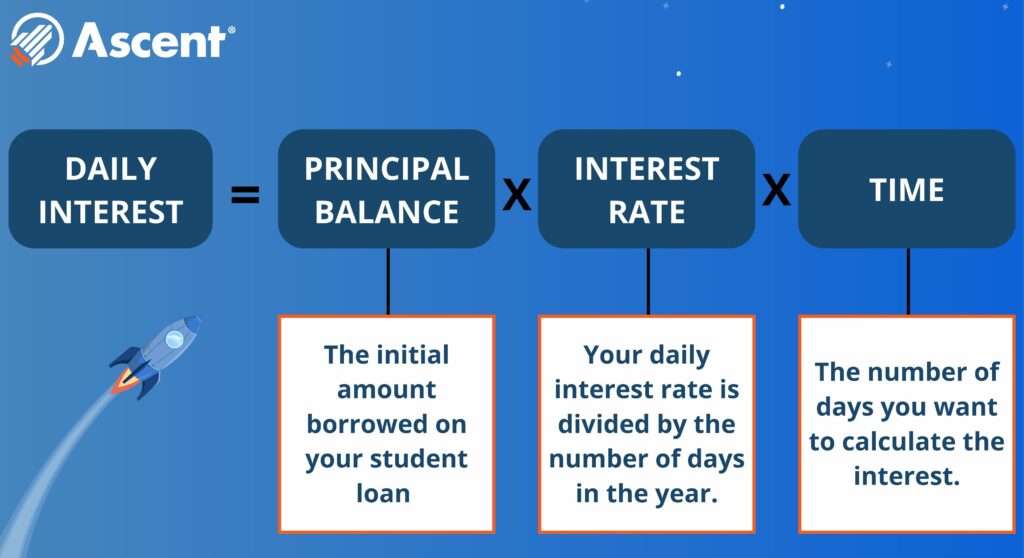

Let’s start by breaking down the equation for calculating student loans.

Interest = Principal Balance x Daily Interest Rate x Time

Principal Balance: The initial amount borrowed on your student loan.

Daily Interest Rate: Your annual interest rate is divided by the number of days in the year.

Time: The number of days you want to calculate the interest.

You can calculate the amount of interest that accrues on your loan by plugging these values into the equation. Continue reading for the steps on how to calculate student loans:

1. Find Your Daily Interest Rate

The first step in calculating your student loan interest is to find your daily interest rate. This is your annual interest rate divided by the number of days in the year. For example, if your annual interest rate is 5%, your daily interest rate would be approximately 0.0137%.

2. Determine Daily Interest Accrual Charge

Next, you’ll need to determine how much interest accrues each day. You do this by multiplying your outstanding loan balance by your daily interest rate. For instance, if your loan balance is $20,000 and your daily interest rate is 0.0137%, you would accrue about $2.74 in interest per day.

3. Multiply by Days in Billing Cycle to Find Monthly Payment

Finally, to find out how much interest you’ll be charged in a month, multiply your daily interest accrual by the number of days in your billing cycle. Continuing with the previous example, if your billing cycle is 30 days, you would accrue about $82.20 in interest for that month.

Tools and Resources for Calculating Student Loan Interest

From college degree ROI calculators to federal loan simulators, there are plenty of tools and resources available to help you understand how to calculate student loan interest. These tools can provide a detailed explanation of your loan, including how much of your payments are towards interest versus the principal and how extra payments or a different repayment plan might affect your total cost.

In addition to online calculators, your loan provider should give you detailed loan statements that break down your payments into principal and interest. Your provider should give you a clear picture of how your payments are applied and how much of your loan balance is still outstanding. If you’re unsure how to read your loan statement or have questions about your interest rate, don’t hesitate to reach out to your lender for assistance.

What is Capitalization of Interest?

When calculating your student loan interest, it’s also important to understand the concept of capitalization. Capitalization is when any unpaid interest on your student loan is added to the principal balance. This can happen at certain times, like when your loan enters repayment or after a period of deferment or forbearance.

When interest is capitalized, it increases the principal balance of your loan, which means you’ll be paying interest on a larger amount. This can increase the total cost of your loan and make your monthly payments higher. This information can help you plan your payments and potentially save money in the long run.

When Student Loan Interest Starts

Interest on student loans typically starts accruing as soon as the loan is disbursed. This means that your loan could accumulate interest even while you’re still in school. However, with some types of loans, like subsidized federal loans, the government will pay the interest while you’re in school, during the six-month grace period after you leave school, and during any periods of deferment. That’s why it is important to understand the difference between subsidized vs. unsubsidized loans.

For unsubsidized loans, the interest starts accruing when the loan is disbursed. If you choose not to pay the interest while you’re in school or during your grace period, it will be capitalized, or added to your principal balance, when you start repayment.

The Importance of Understanding Student Loan Terms

Understanding how student loan interest works is just one part of managing your student loans effectively. It’s also important to know the terms of your loan agreement, including your repayment schedule, the consequences of missing a payment, and what options you have if you’re struggling to make your payments.

For example, many student loans offer deferment or forbearance options, which allow you to temporarily stop making payments or reduce your payment amount if you’re facing financial hardship. However, interest may continue to accrue during these periods, which can increase the total cost of your loan.

Learn More with Ascent

At Ascent, we’re committed to helping students and families navigate the world of college loans and make informed financial decisions. We offer a range of financial wellness resources to help you understand your loan options and manage your student loan debt effectively. Whether you’re just starting your college journey or seeking graduate student loans to help you further your education, we’re here to help you reach your academic and financial goals.

FAQ

How do you reduce the total interest paid on student loans?

You can use several strategies to reduce the total interest paid on your student loans. One of the most effective ways is making a payment more than the minimum monthly amount. Paying above the minimum can help you reduce your principal balance faster, which means you’ll be charged less interest over the life of the loan.

Another strategy is to refinance your student loans. Refinancing involves taking out a new loan with a lower interest rate to pay off your existing loans. Refinancing can reduce your monthly payment and the total amount of interest you pay. However, refinancing isn’t right for everyone, and it’s important to consider the pros and cons before deciding.

What happens if you don’t make student loan payments?

You could face serious consequences if you don’t make your student loan payments. Your loan could become delinquent, and if you continue to miss payments, it could go into default. This can damage your credit score, making it harder for you to get credit cards, auto loans, or mortgages in the future.

In addition, if you default on federal student loans, the government can collect the debt, including garnishing your wages or withholding your tax refund. If you’re struggling to make your student loan payments, it’s important to reach out to your lender as soon as possible. They may be able to work with you to find a solution, such as changing your repayment plan, applying for deferment, or forbearance.

Do student loans have interest?

Yes, student loans do have interest. The interest rate can vary depending on the type of loan and the lender. By law, federal student loans have fixed interest rates, while private student loans can have either fixed or variable rates. The interest on your student loans can significantly affect the total cost of the loan, so it’s important to understand how to calculate interest on student loans and consider the interest rate when choosing a loan.