When Does Student Loan Interest Start To Accrue?

Categories: Blog, For College Students, For Cosigners, For Grad Students, For High School Students, For Parents and Cosigners, For Students

Understanding when student loan interest starts to accrue and how it’s calculated can help you manage your student loan debt more effectively. You can invest in your education without sacrificing your financial future by staying informed and making smart decisions about your student loans. Whether you’re just starting your college journey or working to pay off your student loans, we’re here to help.

What is Student Loan Interest?

Student loan interest is the price paid for the use of borrowed money to pay for school and is typically expressed as a percentage rate over a period of time. It’s calculated on a daily basis, using the outstanding principal balance each day of the student loan term. Understanding how interest works is crucial to managing your student loan debt effectively.

Interest on student loans isn’t just a one-time fee. Instead, it accumulates over the life of the loan, increasing the amount you need to pay back. The specific amount of interest you’ll pay depends on several factors, including the loan’s interest rate, the amount you borrow, and the time it takes to repay the loan.

How Student Loan Interest Impacts the Total Balance

Student loan interest can significantly impact the total balance of your loan. As interest accrues, it’s added to the principal balance of your loan, a process known as capitalization. This means you’re not just paying interest on the original amount you borrowed but also on any interest that’s been accrued over the length of your loan term.

The Importance of Understanding Student Loan Interest

Understanding how student loan interest works is essential for managing your student loan debt and planning your financial future. The amount of interest you’ll pay over the life of the loan can significantly impact the total cost of your education and the amount of debt you’ll need to repay after graduating or leaving school.

Knowing when interest starts accruing on your loans can help you make informed decisions about when to start making payments and how much to pay. It can also help you understand the potential benefits of options like making interest-only payments while in school or refinancing your loans to a lower interest rate.

When Does Student Loan Interest Start Accruing?

So, when does student loan interest start accruing? The answer depends on the type of student loan.

Federal Loans

Federal student loans fall into two categories: subsidized vs. unsubsidized loans. Federal student loans start accruing interest as soon as the loan is disbursed. This means that interest starts accumulating while you’re still in school, not just after you graduate or leave school.

However, the federal government pays the interest on subsidized loans while you’re in school at least half-time, during your grace period, and during any periods of deferment. This means that the loan balance for subsidized loans doesn’t increase while you’re in school or during other deferment periods.

On the other hand, for unsubsidized loans and Direct PLUS loans, the government does not pay the interest that accrues while you’re in school, during your grace period, and during deferment or forbearance periods. If you don’t pay the interest as it accrues, it will be capitalized or added to the principal balance of your loan.

Private Student Loans

Private student loans work differently. Interest on these loans typically starts accruing as soon as the loan is disbursed, just like with federal loans. However, the specifics can vary depending on the lender and the terms of the loan.

Some private lenders offer deferment options, which allow you to postpone payments while you’re in school, but keep in mind that interest may continue to accrue during this time. It’s important to check with your lender to understand when student loan interest starts accruing and how it’s handled during deferment periods.

Tips for Managing Student Loan Interest

When managing student loan interest, staying proactive and informed is the key to success. If you find yourself facing financial hardship, reach out to your lender for student loan forbearance and student loan deferment options to pause payments. Implement effective strategies and take control of your student loan interest. Here are more tips to follow:

Pay Interest While in School

One strategy is to start making interest payments while still in school. Some lenders offer a $25 minimum repayment option for students who can make as little as $25 monthly payments while in school. Chipping away at your student loan debt while in school may help save you money in the long run.

Consider Refinancing or Consolidation

Refinancing or consolidating your student loans can also help you manage your interest payments. Refinancing involves taking out a new loan with a lower interest rate to pay off your existing loans, which can reduce your monthly payment and the total amount of interest you pay. Consolidation involves combining multiple loans into one, making managing your payments easier.

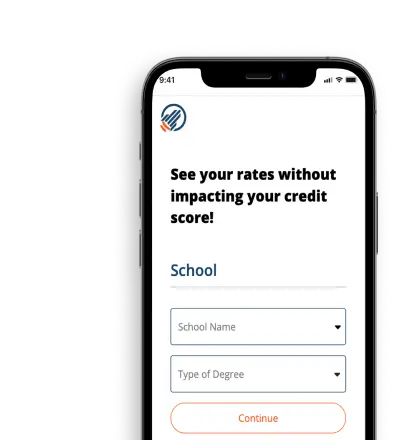

Stay up to date with Ascent

At Ascent, we’re committed to helping students and families navigate the world of college loans. We offer a range of resources to help you understand your loan options, make informed decisions, and manage your student loan debt effectively.

For more information on how student loans may help you pursue your goals, check out our Student Loans:101 Guide or explore more financial wellness resources from Ascent.

FAQs

How often does interest get added to student loans?

Interest on student loans is typically calculated on a daily basis. This means that your loan balance can increase every day. However, the interest isn’t usually added to your loan balance (or capitalized) until certain points, like when your loan enters repayment or after a period of deferment or forbearance.

How can I avoid interest on student loans?

While it’s not possible to completely avoid interest on student loans, there are strategies you can use to minimize the amount of interest you pay. These can include making interest payments while you’re still in school, paying more than the minimum monthly payment, and refinancing your loans to a lower interest rate. It’s also important to understand the terms of your loans and to make your payments on time to avoid late fees and additional interest.

What will student loan interest rates be in 2024?

Interest rates on federal student loans are set by the federal government and can change each year. For the most current information, it’s best to check the Federal Student Aid website or speak with a financial aid advisor at your school.